- Operation of the textile industry in the first quarter of 2024!

- Can polypropylene masterbatches be applied to the product?

- Spring is just right, pack up this sunscreen guide, travel to enjoy!

- Textile and garment industry development status!

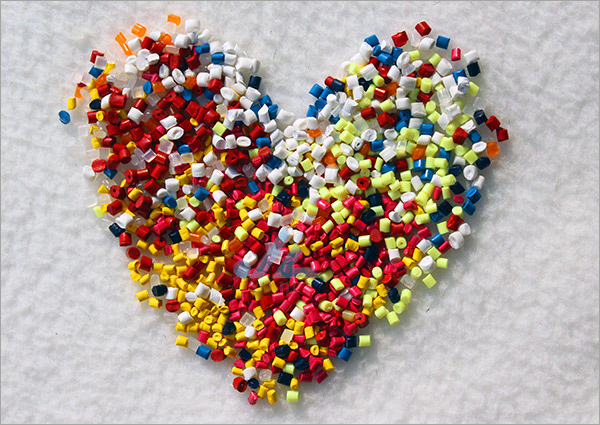

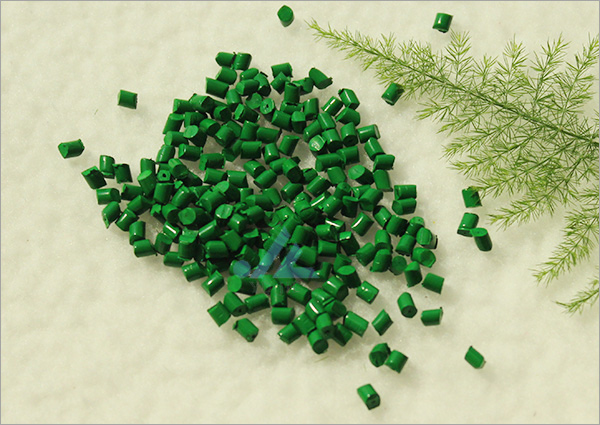

- Application of jade Jie color masterbatch

- From January to March, the fixed asset investment in the textile industry increased by 12.4% year-on-year

- Tel: 0086-13957173655

- Email: zpl620504@163.com

- Add: Canghexia No. 36, Tiyuchang Road, Xiacheng District, Hangzhou, Zhejiang, China

Since 2001, the textile and garment industry has witnessed rapid development and strong demand. Various kinds of small and medium-sized enterprises and home-based workshops have started to engage in printing and dyeing. The industry is very fragmented with low and medium-end production capacity overcapacity and serious environmental pollution and energy consumption problems. However, insufficient.

After 2012, the new ZF will strengthen environmental protection requirements and promote industrial upgrading. Printing and dyeing, as a traditional industry with high pollution and high energy consumption, usher in supply-side reform, environmental protection standards and cost increase, and non-compliance of small and medium-sized production capacity will begin to shrink. In addition, under severe competition, the profitability of the industry is poor. Demand has been gradually weakened since 2012, and the rising costs of labor and land as well as rising prices of coal and dyes have also led to the phasing out of some SMEs. In 2010-2015, the output of backward industries across the industry accounted for 7.0%, 3.1%, 5.8%, 5.9%, 3.9% and 2.4% of the total output of the year respectively. The output of dying cloths of enterprises above designated size dropped from 59.303 billion meters in 2011 to 2015 50.953 billion meters.

Related Report: Research Report on the Special Investigation and Investment Direction of China's Printed Home Textile Market from 2018 to 2024 Released by Zhi Yan Consulting Network

The company is located in:

With the steady domestic demand for printing and dyeing in the lower reaches of 2016 and the transformation and upgrading of printing and dyeing enterprises, especially the leading enterprises, the technical level and environmental protection standards were upgraded, the output of printing and dyeing turned positive from negative growth. In 2016, the output of printing and dyeing fabrics of enterprises above designated size reached 53.37 billion meters, up 4.74% %. In the first half of 2017, the nationwide printing and dyeing cloth production was 27.172 billion meters, an increase of 6.14% over the same period of last year, printing and dyeing production capacity still maintained growth.

Due to the year-on-year decline in the production and sales of the industry after 2012, the revenue growth of printing and dyeing enterprises above designated size is declining, and the growth of net profit is also at a low level. After 2016, the capacity of the industry resumed its expansion and the revenue growth rate of the enterprises rebounded. From January to May 2017, the printing and dyeing enterprises above designated size realized the revenue of 160.186 billion yuan, up by 7.87% over the same period of last year with a total profit of 7.457 billion yuan, up by 8.32% over the same period of last year. The resumption of expansion of production capacity and the gradual improvement of performance have also led to intensified competition and increased concentration and impact.

Dyeing market concentration

In terms of regions, the printing and dyeing enterprises are mainly distributed in the eastern coastal provinces. After the industry demand growth slowed down, these regions are characterized by abundant water resources, well developed upstream and downstream industry chains and strong environmental carrying capacity, which further concentrate their production capacity in advantageous regions. In 2015, the output of printing and dyeing cloths in Zhejiang, Jiangsu, Fujian, Shandong and Guangdong Provinces accounted for 95.95% of the national total, up 4.55% from 2011, of which Zhejiang accounted for more than 60%. Printing and dyeing industry in these areas by the local ZF policy more affected.

The current printing and dyeing industry is still relatively fragmented. In 2016, Aviator's printing and dyeing cloth production capacity was 1.02 billion meters, accounting for 1.91% of the national total, accounting for the top ten in the industry. Jiangsu Shenghong dyeing and printing a total of 18 factories, production capacity of 2 billion meters market share of 3.75%, ranking first in the industry. Domestic printing and dyeing industry is still dominated by small and medium enterprises, such as printing and dyeing town of Shaoxing, more than 200 printing and dyeing enterprises, but only 3 leading local enterprises into the 2017 list of the top 20 printing and dyeing enterprises.

Production capacity of some enterprises in the top 20 in China's printing and dyeing industry in 2017

Analysis of printing and dyeing industry

The profit margin of the printing and dyeing industry is currently at a relatively low level. In 2016, the total profit of printing and dyeing enterprises above designated size accounted for 5.33% of the total revenue. The profitability of SMEs is even worse. The increase of environmental investment will result in the loss of some enterprises having to withdraw from the market.

Dyeing and printing enterprises are mainly divided into processing or processing their own procurement and processing model, which led the majority of Air and liquid materials processing. Printing and dyeing costs include thermoelectric, dyes, artificial and so on. As a high-pollution, high-energy-consuming industries, printing and dyeing enterprises thermoelectric, water and other costs accounted for more than 40%, accounting for more than 20% of dye costs. With the environmental protection requirements increased, coal, dyes and other prices will increase the cost of printing and dyeing enterprises, in addition to the implementation of the new Environmental Protection Act in 2018 after the reform of sewage charges to change the environmental tax, to further increase the cost of business especially those with serious pollution burden, printing and dyeing enterprises will be raised Price transfer cost pressure.

After 2017, the environmental protection requirements will be further tightened. Jiangsu Province started the inspection of "263" action to limit the production capacity of small and medium-sized dye-polluting enterprises and significantly reduce the starting-up volume of leading enterprises. In September 2017, the fourth group of Central Environmental Inspectors stationed in Zhejiang and Shandong closed a large number of dye factories and pushed up the prices of disperse dyestuffs. The mainstream ex-factory price of disperse black ECT300% was 45 yuan / kg in October 2017, up nearly 80% from June %. In addition, due to the continued capacity of coal to go, the rapid growth of power generation coal consumption and so on, in July 2017 coal prices rise again.

- Can polypropylene masterbatches be applied to the product?

- Operation of the textile industry in the first quarter of 2024!

- Spring is just right, pack up this sunscreen guide, travel to enjoy!

- Textile and garment industry development status!

- Application of jade Jie color masterbatch

- From January to March, the fixed asset investment in the textile industry increased by 12.

- In May, | Zhejiang Jinchun will be invited to meet you for the 31st International Tissue P

- Future textile industry status analysis!

- Introduction of Hangzhou Yujie Chemical Co., LTD

- Textile industry operation "stable"!